DEBT MANAGEMENT

Many circumstances require you to take out a loan, borrow money or use Credit Cards to purchase goods & services. The amount you borrow becomes ‘debt’ that you owe to whoever has financed the amount, whether it is a financial institution, bank, friend, or family member.

In the context of Credit Cards, a debt payment obligation becomes effective and binding when you, as a cardmember, use the card as allowed by the issuer’s terms and conditions

Reasons for taking on debt can be:

Paying for planned expenses like education fees, marriage, home renovations, household needs, and typical discretionary travel & entertainment spending on Credit or Charge Cards.

Large purchases, such as a car or real estate.

Unplanned events or emergency expenses such as vehicle repairs, medical bills, or covering for an unexpected temporary income or cash flow shortfall.

Before taking out a loan or a credit card you should, at the least, consider the below questions:

What are the terms and conditions of the contract or product?

What is the status of my existing debt payment obligations and how will this affect my credit bureau report and debt burden ratio?

What is the duration of the loan? How long will it take me to repay the debt in full?

What is the interest rate charged and is it fixed or subject to change?

How much should I pay per month or annually? Can I afford it?

Do my repayments include interest and principal or interest only?

Are there any charges other than interest, monthly or annually? What happens if I miss a payment or if I go over limit on a card?

Can I pay a lump sum or make a balloon payment to pay down the debt?

Do I need to consider legal advice before signing the agreement?

What are the legal consequences if I am unable to repay?

Credit and Charge Cards

Credit Cards are a unique form of personal debt as they allow you the convenience of purchase of goods & services for re-payment at a future date, either in full or over time.

Charge Card obligations typically always require full payment of the entire balance on a given statement of charges by a specified due date. Charge Card products are generally interest free and most suited to individuals that have financial ability and discipline to pay off their entire periodic spend obligations without any stress on their cash flows. Charge Cards are essentially a payment tool to manage spends and expenses that can be paid off within a short-term, typically of less than 30 days. Charge Cards must never be used to take on debt, and when not paid in full by the specified due date, such obligations do become a fully and immediately payable Debt.

Credit Cards on the other hand allow you to have flexibility of only paying a Minimum Payment every month typically of 2.5-10% of the balance. Depending on interest rate charges & the Minimum Due feature of a Credit Card, the monthly repayments may or may not reduce principal owed to the credit granting financial institution. As with any other debt, Credit Card debts should only be stretched when necessary and efforts should be made to pay off the principal amount as early as possible.

Debt and Personal Financial Distress

Your financial standing and circumstances can take unexpected turns and present situations that result in adverse effects on your cash flows for a short or undetermined period; or you could have simply mismanaged your finances and over extended yourself to a point that your debt is unsupported by your income.

Such events may cause you to fall behind on your monthly Minimum dues or are simply unable to progress with your repayments resulting in the debt going into arrears. You are now in a Personal Financial Distress situation that, if not managed properly, can result in a range of consequences including but not limited to Penalty Interest Charges, Late Fees, Credit Score deterioration, limitations on future borrowings, and in extreme cases possible civil or criminal legal actions with repossession or attachments of your assets and garnishing of income.

The first step in dealing with debt issues and problems of arrears is to realize that it is not going to go away on its own, and if ignored, it will only get worse. As soon as you realize that your debt is becoming unmanageable, you should put together a Personal Debt Management Plan. This typically consists of the following steps:

Dimension Your Obligations

Sum up your monthly debt obligations by reviewing your credit bureau report (Al Etihad Credit Bureau). For information on obtaining your Credit Report and Credit Score online visit aecb.gov.ae or by visiting their offices.

Determine all other obligations that you will need to settle that are outside the Credit Bureau report – borrowings outside UAE or from informal sources e.g. friends, family, etc.

Determine Your Resources

Aggregate all your possible income sources and cash flows.

Consider raising money by selling unencumbered, moveable or immovable assets or securities.

Discuss with your employer on potentially increasing your income even if temporarily.

Evaluate options of paid overtime, alternate or second employment.

Any other bona fide source of income or cash.

Downsize Your Expenses to absolute necessities

Suspend or cancel all digital subscriptions.

Consider cutbacks in lifestyle expenses, e.g. exchange your car with a more affordable one, shop non-branded for essential items.

Suspend all avoidable discretionary consumption expenses.

Consider reducing your rental expenses e.g. move to a less expensive area or house.

Suspend or cancel club memberships.

Limit all travel, shopping and restaurant expenses to critically essential ones.

Prioritise debt repayments

Now that you have a revised sketch of your finances, next determine the priority of your repayments. The below points serve as a good reference:

Always pay the most expensive debt (i.e. the debt with the highest interest rate) first, as that will grow fastest due to ongoing interest and late charges.

Informal debt obligations to family and friends can generally be re-negotiated and requested for later payment.

This brings you to the execution step of your Personal Debt Management Plan of making payments to your lenders/creditors. Based on your debt priorities, make as many balloon payments as possible to reduce your debts with the money raised in step 2, and restart monthly or other periodic payments immediately.

Paying off debt, especially when in financial distress, requires a hands-on disciplined approach that starts with a robust plan and may also involve engaging with creditors to understand what works best for you. In addition to the aforementioned method, other considerations include:

Self-help by developing a robust budget to take control of your financial situation by doing a realistic assessment of how much you can afford to spend and repay.

Contact your creditors and explain your circumstances to them, well in advance of the institution turning over the debt to a lawyer.

Seek advice from the financial institution’s Credit Counsellors, who are trained to assist you in developing a plan considering your circumstances.

Explore debt consolidation, loan take over, or rescheduling of instalment debt options available for you in the market. However, as a general guideline, avoid taking on debt that is more expensive, in order to pay off a cheaper one that you may already have.

Credit Counsellors - Role and Function

A Credit Counsellor provides the role of a listener, coach and ultimately an educator that you may be looking for when you feel overwhelmed about your debt repayments.

Credit Counsellors are certified and trained to work closely with or within the financial institutions to perform the following key tasks

They will evaluate your credit report, income and expenses.

They will discuss with you your financial challenges that you are currently facing or may likely face in the future.

They will assist you in coming up with a plan to overcome the challenges in debt repayment and resolving arrears.

At American Express, Credit Counsellors assist our Cardmembers in dealing with debt issues and arrears management by developing practical personal debt management plans.

In all cases, the key to a productive conversation with a credit counsellor is your financial transparency i.e. you providing exhaustive details of your financial standing. An additional real catalyst for a good outcome is your sincere commitment to honour your obligations.

How to reach Credit Counsellors at American Express in the UAE

During stressful times, we are here to help. American Express has dedicated Credit Counsellors who can discuss your personal situation and help you in creating your personal Debt Management Plan.

Credit Counsellor Hotline: +971 4 4492235

Credit Counsellor Email ID: creditcounsellor.uae@americanexpress.ae

Please only write to us from your email ID registered with American Express and include the following details in your message:

- Your American Express Account Number

- Full Name as it appears on the American Express Card

- UAE ID Number

- Registered Mobile Phone

Credit Counsellors are only able to suggest solutions that work for your individual circumstances based on the information provided by you. All solutions are intended to assist you to honour your financial commitments and reduce your debt in a dignified manner.

Our Credit Counsellors do not provide or arrange debt consolidation services.

All credit counselling is provided in good faith on a best effort basis and has no guarantee of successfully improving your financial situation.

For details of Fees that maybe imposed on Consumers in Arrears at American Express UAE, please click on the relevant product at American Express UAE.

Self-help Tools

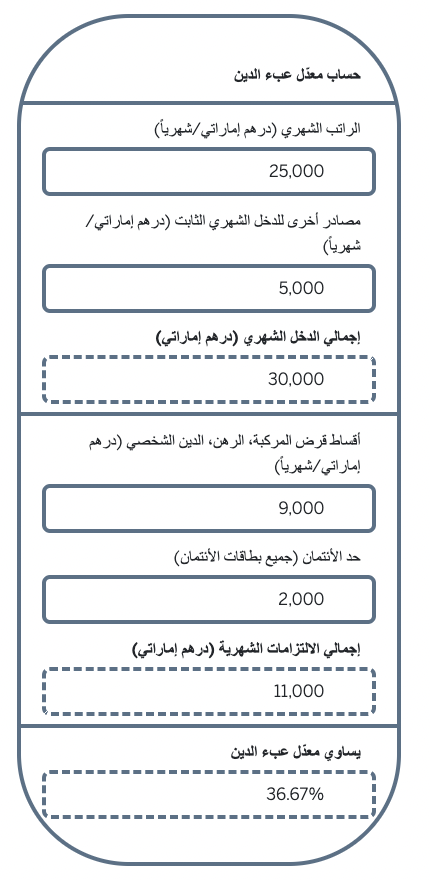

| Understanding Debt Burden Ratio Debt Burden Ratio, or DBR, is the ratio of total monthly instalments or commitments to the total income of an individual. DBR is expressed as a percentage, and is generally used to assess debt repayment affordability – as a rule of thumb you should keep this ratio below 50%. To calculate your DBR, sum up all of your monthly debt obligations that may include all loan instalments, instalment based credit taken on Credit Cards and the Minimum amounts due to be paid on all your Cards*. Dividing the sum of your monthly obligations by your monthly income will result in the calculation of your DBR. The figure on the right is a typical self-help illustration to assist you in calculating your DBR. In this illustration: Total Monthly Income is equivalent to the sum of all fixed sources of revenue e.g. Salary, Rental Income, Interest on Deposits or Investments, etc., here aggregating to a Total Monthly Income of AED 30,000. Similarly, Total Monthly Debt Payments are a sum of all fixed obligations e.g. Mortgage payments, Car Loan payments, Other Instalment Loan payments, Monthly Minimum Due across all Credit Cards** and any other monthly obligations, etc., here aggregating to total monthly obligations of AED 11,000. Total Monthly Repayment / Total Monthly Income AED 11,000/ AED 30,000 = 36.67% is DBR We will continue to add more self-help tools—Watch this space. |

The use of your American Express Card issued by AMEX (Middle East) B.S.C. (c) – Emirates is subject to the terms and conditions available on this website: American Express UAE.

The material made available for you on these pages is for informational and educational purposes only. This information is not intended to provide legal or financial advice. If you have questions, please consult your own professional legal and financial advisors.’

* Excluding Charge cards, as explained charge cards require full repayment of all balances and need confirmed future cash flow allocated to its repayment; hence they sit outside typical DBR calculations.

** For general DBR calculations, you should assume that full limit is utilized on all credit cards and unless stated otherwise, 5% of total credit card limit is payable as a minimum amount due on a monthly basis.